e-Waybill

e-Waybill is an electronic waybill required to be generated on e-Waybill Portal for the movement of goods. India Compliance offers multiple ways to manage your e-Waybill compliance.

You can generate the e-Waybill using the bulk generation facility or the APIs.

Supported DocTypes to generate e-Waybill

- Sales Invoice

- Purchase Invoice

- Delivery Note

- Purchase Receipt

- Stock Entry

- Subcontracting Receipt

Prerequisites

- GSP credentials in ERPNext

- India Compliance Account

- API should be enabled under GST Settings.

- e-Waybill Configration

e-Waybill Generation Using API

- On submitting the sales invoice, e-Waybill shall be automatically generated (if enabled in settings).

- You can manually trigger the generation of an e-Waybill for Delivery Note or where all fields were not present (on submit).

Go to the e-Waybill menu --> Generate dialog --> Update fields and click Generate.

How would I know if only Part A of the e-Waybill will be generated?

Dialog for Generate e-Waybill fields has separate sections for Part A and Part B. Also, the Primary Action button will denote if only Part A can be generated.

How to auto calculate the distance for e-Waybill?

If the distance is set to zero (0), e-Waybill Portal will suggest the distance between postal codes. We shall update it to your document where e-Waybill is generated using the APIs.

In some exceptional circumstances, where the distance between postal codes is unavailable with the e-Waybill database, you shall receive a prompt. Generate the e-Waybill again after entering the distance as per your estimate.

Update Transporter Details

WARNING

Updating or cancelling e-Waybill is possible only within the validity period. These options will be visible only if you have generated the e-Waybill using API and the validity to do so has not expired.

Use this feature to update the GSTIN of the transporter to your e-Waybill.

From e-Waybill menu --> Select Update Transporter --> Update appropriate information and click update.

Update Vehicle Information

Use this feature to update the vehicle information (say, vehicle number) to your e-Waybill.

From e-Waybill menu --> Select Update Vehicle Info --> Update information in dialog and click update.

There is a checkbox in the dialogs above for

Update e-Waybill Print/Data. If you check this, we shall update the attachments of the e-Waybill or Data concerning the e-Waybill as per your preference from GST settings for e-Waybill. IfAttach e-Waybill Print After Generationis enabled from GST Settings, new attachments will replace old attachments.

Extend e-Waybill Validity

The validity of e-Waybill can be extended between 8 hours before expiry time and 8 hours after expiry time. From the e-Waybill menu, Click on "Extend Validity". In the dialog box, enter the required details, specify the reason for the extensions and click Extend to extend the validity of the e-Waybill.

- click on "Extend Validity"

- Update the required details in the dialog box.

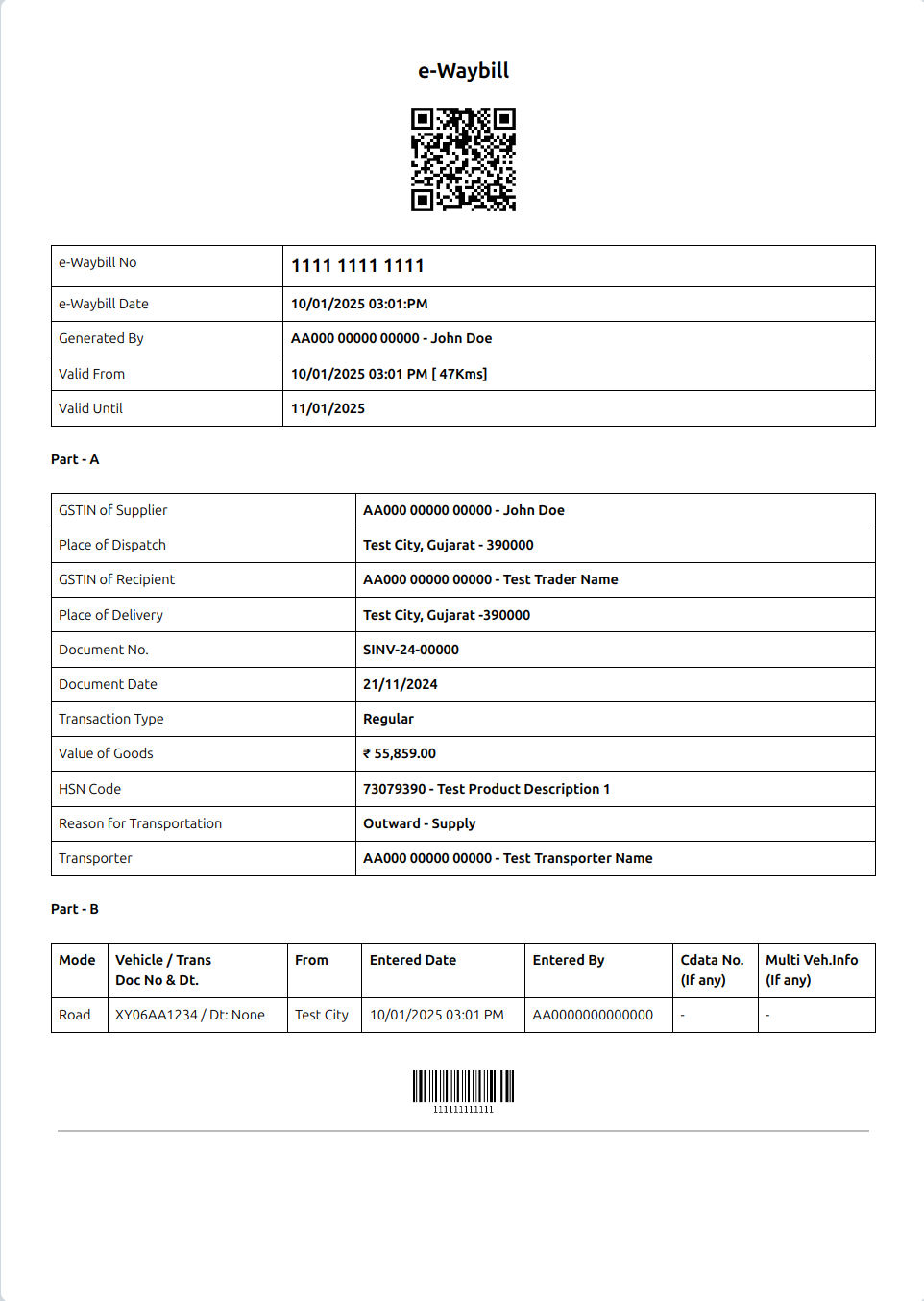

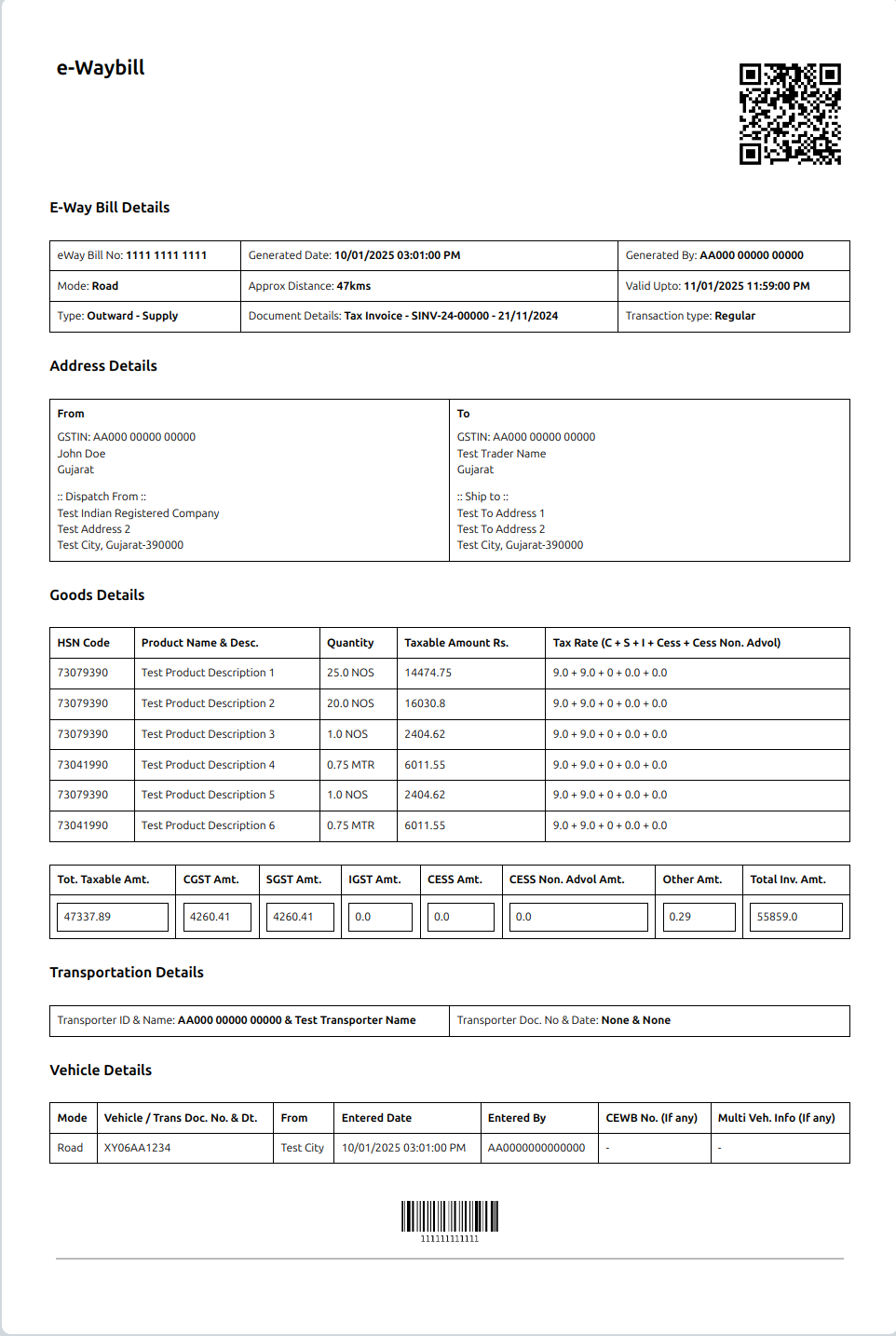

Print e-Waybill

You can use this to print an e-Waybill if you prefer not to have attachments. It works similarly to printing any other document in ERPNext. It will redirect you to the respective e-Waybill log print and fetch the latest e-Waybill data (from the NIC Portal) for printing if it's not available.

You can print e-waybill in two formats similar to the e-Waybill portal:

- A Simplified Format using "e-Waybill" print format

- A Detailed Format with additional fields using "e-Waybill Detailed" print format

E-Waybill Simplified

E-Waybill Simplified E-Waybill Detailed

E-Waybill DetailedAttach e-Waybill

It is a manual trigger to attach an e-Waybill to a Sales Invoice. A new attachment will replace the old attachment if present.

Set one print format from the options above as the default for the e-Waybill Log, and it will be automatically selected when you attach it to a Sales Invoice. You can also create a new print format from scratch and use it as the default.

Cancel e-Waybill

If within validity, you shall be allowed to cancel the e-Waybill.

From the e-Waybill menu, Cancel e-Waybill. In the cancellation dialog, Specify the reason for cancelling and click cancel to cancel the e-Waybill.

While you cancel the e-Waybill, the attachment of the old e-Waybill, shall be removed.

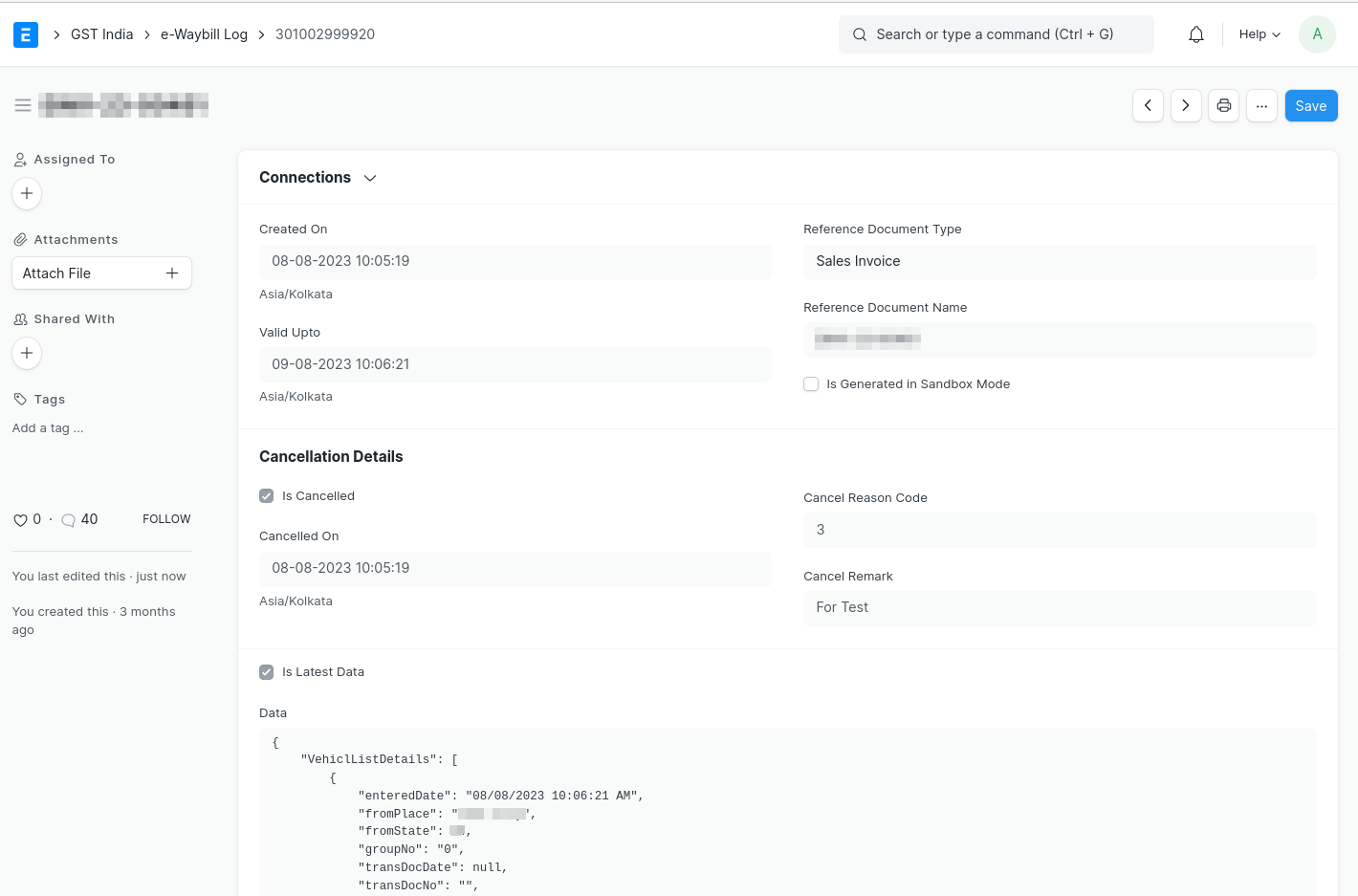

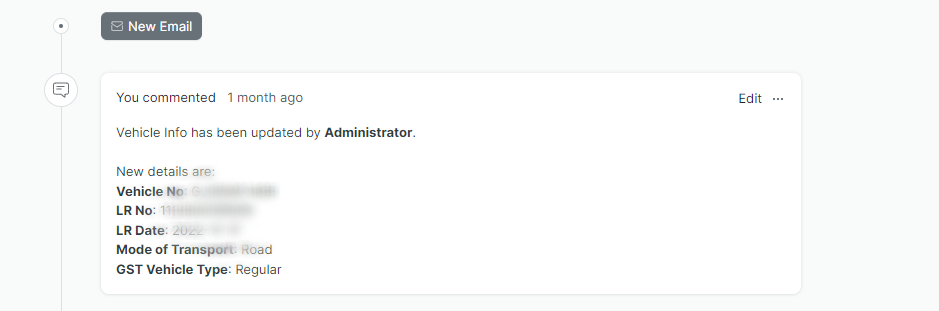

e-Waybill Logs

In this DocType, e-Waybill history is maintained. It will be created in the background once you generate an e-Waybill using the APIs. Any further updates to e-Waybill are added here as a comment.

Updated Log

Bulk e-Waybill Generation

e-Waybills can be generated in bulk in two ways.

- Generate e-Waybill JSON

- Enqueue Bulk e-Waybill Generation

1. Generate e-Waybill JSON and Upload it to GSP Portal

- Select the documents from the Sales Invoice List for which you want to generate an e-Waybill JSON.

- Click Actions --> Generate e-Waybill JSON

- Login to your e-Waybill Account --> Select Generate Bulk e-Waybill --> Choose the JSON file and upload it --> Click Generate.

- e-Waybill shall be generated --> Update the e-Waybill number in your Sales Invoice / Delivery Note.

2. Enqueue Bulk e-Waybill Generation

- Update the documents with Transporter details for which you want to generate e-Waybills in bulk.

- Select the documents from the list view, and from actions click on to option "Enqueue Bulk e-Waybill Generation".

- e-Waybills will be enqueued for the selected documents.

e-Waybill JSON Genration

Steps to generate e-Waybill JSON for a single document

- Submit the relevant document(say Sales Invoice).

- If e-Waybill is applicable for the current document, you shall see the e-Waybill menu --> Select Generate.

- Generate e-Waybill dialog box shall appear.

- Update the transport fields and Download JSON.

- Login to your e-Waybill Account --> Select Generate Bulk e-Waybill --> Choose the JSON file and upload it --> Click Generate.

- e-Waybill shall be generated --> Update the e-Waybill number in your Sales Invoice / Delivery Note.

WARNING

You shall not be able to update transport fields while you download e-Waybill JSON from the Sales Invoice List.